Aegon Life has launched a term life insurance with a COVID-19 cover for hospitalisation expenses up to Rs 1 lakh which can be bought on the Flipkart app. The policy is issued only for 1 year. This means that both the COVID-19 cover and term insurance will expire after one year from the date of purchase of the policy. Also, it is a term insurance cover, so there is no maturity benefit or survival benefit payable to you on the coverage expiry date of the policy.

The policy is not available for senior citizens as only those aged between 18 years and 50 years can buy this policy.

According to the press release, this launch is aimed to provide Flipkart customers with a comprehensive insurance cover against COVID-19, that can be availed on the e-commerce company’s app instantly along with the base life insurance plan. This cover supports the policyholder by covering hospitalisation costs of up to Rs 1 lakh on minimum 24 consecutive hours of hospitalisation on the first diagnosis of COVID-19, along with death benefit from the life cover.

How the life insurance plan works

Scenario 1: If you have opted for the term life insurance plus COVID-19 cover for Rs 10 lakh sum assured and COVID-19 condition and are hospitalised for 24 consecutive hours, then you will be paid Rs 1 lakh and the policy will continue with all benefits.

Scenario 2: Again let us assume that you have taken a term plan with a sum assured of Rs 10 lakh. In case of death due to COVID-19 or death due to any other reason, your family will get paid Rs 10 lakh as death benefit and the policy will be terminated.

Currently, four types of term insurance plans from Aegon Life are available on the Flipkart app.

- The premium for Rs 5 lakh sum assured costs Rs 903. In this policy, the insurer will pay Rs 50,000 lump sum payout on hospitalisation for than 24 hours due to COVID-19.

- However, for the rest of the plans, that is, Rs 10 lakh sum assured (premium of Rs 1,805), Rs 25 lakh sum assured (premium Rs 3,737), Rs 40 lakh sum assured (premium Rs 5,669), the insurer will pay Rs 1 lakh lump sum payout on hospitalisation more than 24 hours due to COVID-19. The premium cost is inclusive of GST.

Only one policy can be purchased per Flipkart account. Satishwar Balakrishnan, CFO, and Principal Officer, Aegon Life said, “Our goal through Aegon Life’s ‘COVID -19 Hospitalization Cover’ is to provide financial aid bundled with life benefits at an affordable premium. The policy takes care of hospitalisation costs, which will help curb the financial burden that may arise if a person is declared COVID-19 positive. In case of death, one can avail of the life benefit through the base plan, which will help in supporting the insured’s family.”

Exclusions under COVID-19 policy offered by Aegon life

The policy comes with a waiting period of 14 days from the policy start date. Further, you should have not travelled outside of India in the last 45 days from the date of proposal and not been quarantined or been in close contact with anyone who has been diagnosed positive for COVID-19 in the last 14 days from the date of the proposal. Added to this you should not have symptoms of fever, cough, shortness of breath, malaise, sore throat, nausea, vomiting or diarrhoea within the last 14 days from the date of the proposal.

How to buy term life insurance with COVID-19 cover using Flipkart app

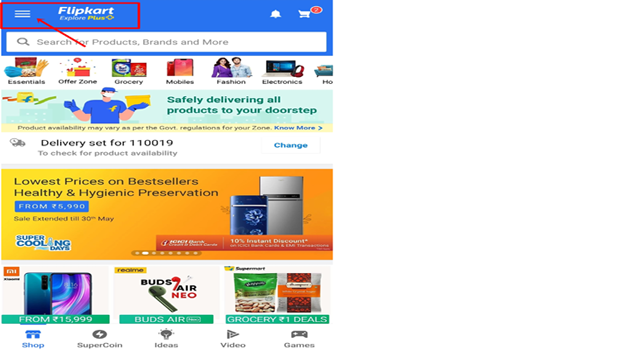

Step 1: Download the app and login with your mobile number. Click on the home button.

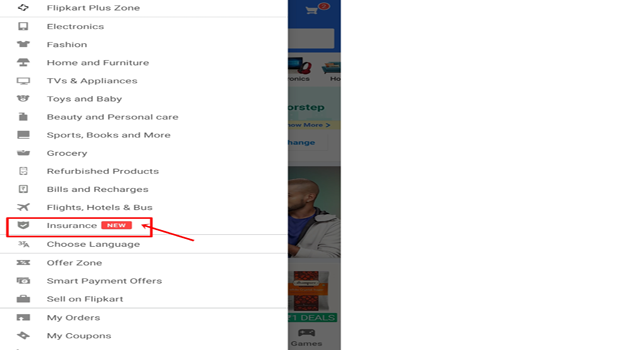

Step 2: Click the insurance tab and proceed further.

Step 3: You will be redirected to the new screen which shows types of insurance plan offered by various insurers. Here you need to click on ‘Life’ tab and proceed further.

Step 4: After clicking on the life insurance tab, you will be redirected to Agon Life portal for policy purchase. Now you can choose the policy from the following four options available.

(Inputs from Aegon life FAQs mentioned on Flipkart app)

source: economictimes